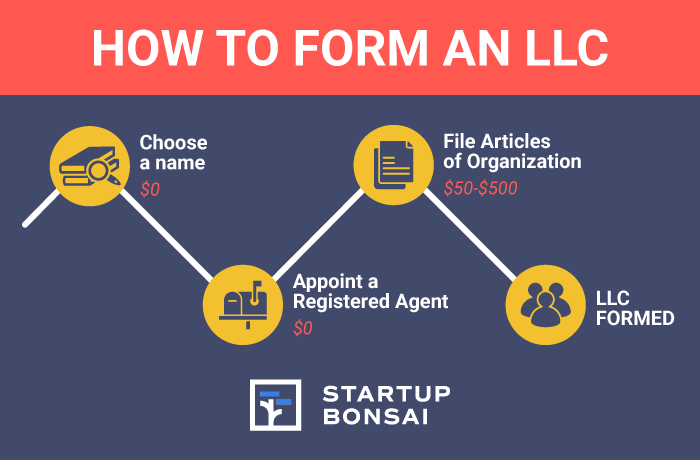

How To Form An LLC In 4 Easy Steps

Ready to form an LLC in the best and cheapest way possible?

We’ve got you covered! This post contains 4 easy and stress-free steps to form an LLC.

“But…shouldn’t I hire a lawyer first?”

Nope! Forming an LLC requires zero legal expertise.

Here’s why:

Forming an LLC (i.e. Limited Liability Company) is an easy, uncomplicated way to begin your entrepreneurial journey. It’s like a corporation, but with the advantage of not being personally accountable for any business debts.

However, an LLC is more popular amongst small business owners because of:

- Protection against personal liability

- Taxation benefits

- Management flexibility

- Fewer reporting requirements

Ready to save hundreds of dollars on unnecessary legal fees?

What are you waiting for? Read on!

Note: Click here to register your LLC online with our partner, ZenBusiness. You’ll be set up in around 10 minutes.

Step 1. Choose a state for your LLC

To get started, choose a state.

You can shortlist the state based on where your business intends to be located. If you are confident of doing business in more than one state, then you can choose your state based on:

- Convenience

- Lower taxes

- Lesser paperwork

Step 2. Choose a name for your LLC

Pick a unique name for your LLC, complying with your state’s naming rules. Make sure the name ends with an LLC designator, such as Limited Liability Company or Limited Company or LLC.

Legally speaking, the name you choose should neither be “deceptively similar” to another company’s name nor “distinguishable on the record” of your state. To rule this out, you can pick a unique name on a free Business Name Generator Tool. You can also check name availability on your state’s online entity name check tool.

Here are the relevant links for all 50 states within the U.S.A:

| Alabama Secretary of State: Business Entity Search | Georgia Secretary of State: Business Search | Maryland Secretary of State: Charter Record Search | New Jersey Department of State: Business Entity Name Search | South Carolina Secretary of State: Search Business Filings |

| State of Alaska: Corporations Database | State of Hawaii: Business Entity & Documents Search | Massachusetts Secretary of the Commonwealth: Business Entity Search | New Mexico Secretary of State: Business Entity Search | South Dakota Secretary of State: Business Information Search |

| Arizona Secretary of State: eCorp Business Entity Search | Idaho Secretary of State: Business Entity Search | Michigan Secretary of State: Business Entity Search | New York Department of State: Corporation & Business Entity Database | Tennessee Secretary of State: Business Information Search |

| Arkansas Secretary of State: Business Entity Search | Illinois Secretary of State: Corporation & LLC Search | Minnesota Secretary of State: Business Entities Search | North Carolina Department of the Secretary of State: Corporate Name Search | Texas Secretary of State: Taxable Entity Search |

| California Secretary of State: Business Search | Indiana Secretary of State: Business Search | Mississippi Secretary of State: Business Search | North Dakota Secretary of State: Corporate Name Search | Utah Secretary of State: Business Name Search |

| Colorado Secretary of State: Business Database Search | Iowa Secretary of State: Business Entities Search | Missouri Secretary of State: Business Entity Search | Ohio Secretary of State: Business Search | Vermont Secretary of State: Business Search |

| Connecticut Secretary of State: Business Inquiry Search | Kansas Secretary of State: Business Entity Search Station | Montana Secretary of State: Business Entities Search | Oklahoma Secretary of State: Search Corporation Entities | Virginia, Commonwealth: Business Entity Search |

| District of Columbia: Registered Entities Search | Kentucky Secretary of State: FastTrack Business Organization Search | Nebraska Secretary of State: Corporation and Business Search | Oregon Secretary of State: Business Name Search | West Virginia Secretary of State: Business Entity Search |

| State of Delaware: Business Entity Search | Louisiana Secretary of State: Business Filings Search | Nevada Secretary of State: Business Entity Search | Pennsylvania Department of State: Business Entity Search | Wisconsin Secretary of State: Corporate Records Search |

| Florida Department of State: Business Name Search | Maine Secretary of State: Corporate Name Search | New Hampshire Secretary of State: QuickStart Business Search | Rhode Island Secretary of State: Corporate Database | Wyoming Secretary of State: Business Entity Search |

Note: If the link to your state’s business name search is broken, don’t worry. Some of these pages are taken down every so often only to be restored sometime later.

Step 3. Appoint a Registered Agent

Most states require LLCs to have a Registered Agent. A Registered Agent is nothing but an individual or business that sends or receives legal papers on behalf of the LLC. This could be anyone, even you. All this person needs is a physical street address in the state where the LLC is intending to form.

Step 4. File Articles of Organization

It is legally required to file Articles of Organization (also called Certificate of Formation/Organization) with the Secretary of State (or your state’s corporate filing office). All that’s required is to fill out a short form usually available on your Secretary of State’s website with basic details, like:

- Name and address of the LLC

- Name and address of the Registered Agent

- Purpose of forming the LLC

- Names of the LLC owners

This protects your LLC structure so that if you’re sued, you won’t have to abide by your state’s rules. You definitely don’t need to hire a lawyer for this step because each state’s rules are pretty much self-explanatory. Most states charge a filing fee between $50 to $500. This is the only investment you need to make towards the formation of your LLC.

While LLC formation takes 1 or 2 days, the receipt of processed documents takes anywhere from a few days to a few weeks, depending on your state. After this is filed and approved, you will receive a Certificate issued by your state and your LLC is thereby officially formed! Congratulations!

Hereafter, your LLC can start functioning after preparing an Operating Agreement, receiving an EIN and other business permits or licenses (depending on the nature of your business).

Bonus

Operating Agreement

It is strongly recommended to hold an organizational meeting with the LLCs members/managers in order to prepare this internal document. It lays down the rules, guidelines and details of your LLC, such as ownership structure, member rights & responsibilities, dissolution and so on.

If you don’t prepare an operating agreement, the Laws of your state will govern how your LLC operates. While you’re at it, you could even issue membership interest certificates and authorize the opening of a bank account for the LLC.

States requiring Operating Agreement:

- California

- Delaware

- Maine

- Missouri

- New York

EIN

If your LLC has more than 1 member or it’s taxed as a corporation (not a sole proprietorship), make sure to apply for an Employer Identification Number (EIN).

All you have to do is fill the Internal Revenue Service (IRS) Form SS-4 and file it on the IRS website – free of charge. But you have to apply only after your LLC is approved so that the IRS can link the EIN to your LLC, and not to you personally.

Publish a notice

Depending on your state’s requirements, you might have to publish a small newspaper notice of your intent to form an LLC. This notice is usually published several times over a period of weeks, eventually informing the Secretary of State (or your state’s corporate filing office) of the same by way of an affidavit. Associated fees may be paid either to the newspaper or to the state government.

States requiring Notice:

- Arizona

- Nebraska

- New York

Conclusion

And that’s it! You now know how to form an LLC for your business. Now, it’s time to implement what you’ve learned and start your LLC.

Disclosure: If you buy through links on our site, we may make a commission. This helps to support the running of Startup Bonsai.